The Kraljic Portfolio Purchasing Model

For many years, at conferences and procurement events many of you probably have heared about the Kraljic Matrix. Many of you may even use it in your day-to-day work. Today we decided to brouth this tool on board because we got an impression that matrix is described in a very general way, characterizing only 4 fields of the matrix. This article is not a full review how to use this tool. We would like to point out only that all debates about tool focus on the quadrants of the matrix but in our opinion this requires more depth analysis. The method discussed below together with the ABC is one of the basic tools supporting a procurement manager in the management of suppliers and we can say even that it has been effectively supplanting ABC in our profession.

HISTORICAL OVERVIEW:

Let’s start with short story: the Peter Kraljic’s procurement prtfolio model (this is real name of this tool) colloquially called the Kraljic matrix for the first time appeared in the Harvard Business Review in 1983. This model is based on the developed analysis model for capital investments from the 1950s and has been adapted to the procurement requirements by Peter Kraljic. Despite its age, it is still a useful tool in analyzing the company’s purchases. Although for the last 35 years a mass of more detailed and advanced methods and analysis tools has emerged, we are sure that by this tool a perception of procurement and purchasing was changed in companies. Simplicity of one of the main reason of huge success of this tool.

PURPOSE:

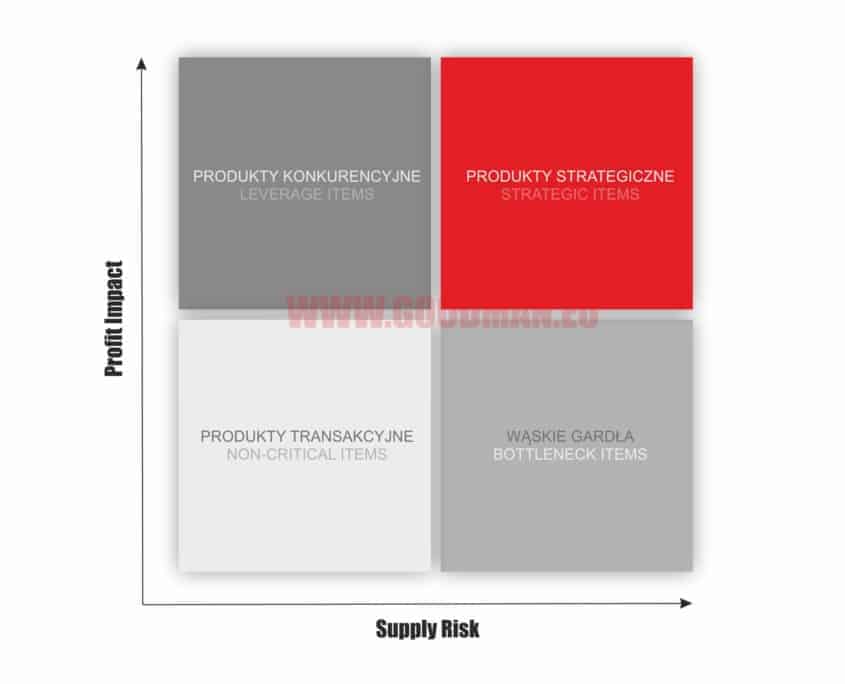

Main purpose of this analysis is to help buyers maximize the secure of supply and reduce costs by maximizing their purchasing power. The Kraljic model analyzes the entire company’s purchasing portfolio to support development of an appropriate strategy for individual, products, groups of suppliers or procurement categories. Each item in the portfolio is assigned to one of four groups in terms of purchase risk and profit impact (matrix is shown on the following picture):

Transaction products – the supply risk and cost of purchase is very low.

Leverge products – the cost of purchase is large, but it is easy to obtain.

Strategic products – critical for the company and with high supply risk.

„Bottlenecks” – products with a high supply risk, but with a low cost. Usualy this products are manufactured by small group of suppliers, or where the market demand exceeds supply.

4 STEPS MAKING OF PETER KRALJIC MODEL:

To carry out a full analysis correctly, the following four steps should be implemented:

1. Purchase classification.

2. Market analysis.

3. Strategic positioning.

4. Action planning.

Purchase classification:

We classify all purchases (categories) based on two criteria:

The impact on profit – is high when the cost of the product is a significant value in the total value of the final product. It can also be purchased volume or value, impact on the value added of the supply chain, etc. The most famous version of this criterion relates to the value of expenses for individual suppliers, for products / services. Where category management is in place, than we should focus on the spend in procurement categories.

Supply risk – grows when the material or service is rare or difficult to obtain due to technology, distance or, for example, political problems. Specific product / service may have a high risk ratio, if is difficult to change suppliers, has a big influence on the continuity of production or availability of substitute is limited. A low risk will arise when a product or service is widely available on the market from many suppliers. This factor does not take into account the price. When determining the risk, we can take into account impact on the production process, the risk of shortage, the rate of change (raw materials, suppliers, technologies), etc.

However, before we classify of purchases, we should analyze all expenditures on goods and services that the company acquires, remembering to separate them into addressed and non-addressed type i.e. those for which the purchasing department has an influence and those for which it does not exist. We hears very often that a company spends several million or several billion per year, however, after the classification we realized that procurement department has an impact on about 70-90

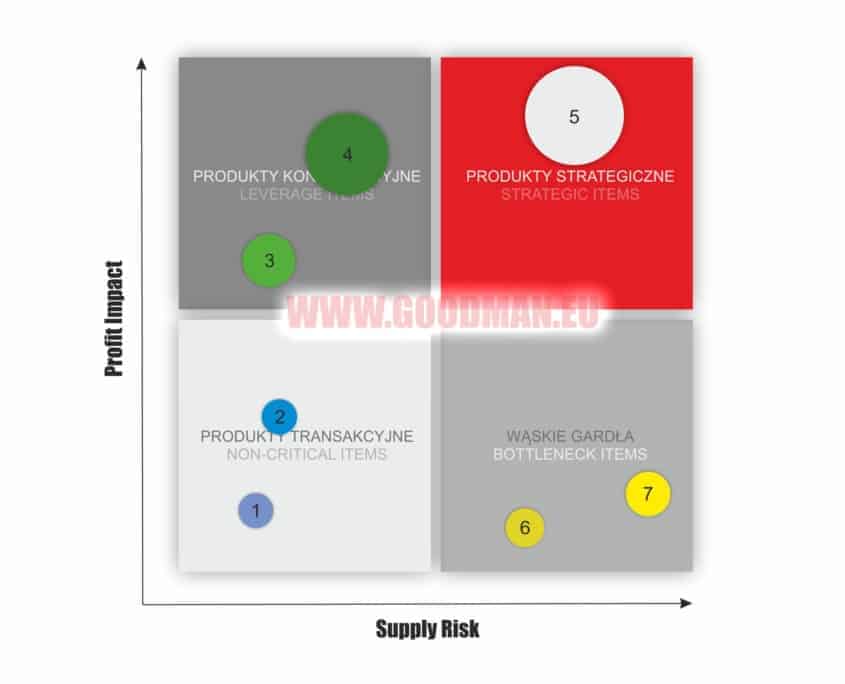

Using the above criteria, we sort all purchased items into the categories presented below and apply to the chart with the following view:

Market analysis:

At this stage, we should check what strength our suppliers have and what our purchasing power is on the market. The analysis of five Porter forces is a frequently used method of analyzing these factors. For the needs of our projects, Porter’s is supported by A.Cox’s matrix adjusted by us.

Strategic positioning:

After determining the supplier’s position and market analysis, materials / categories / suppliers (especially the strategic ones) should be assigned to the Purchase Portfolio Matrix. The purchase portfolio matrix analyzes the purchasing power of the company relative to the strengths of the supply market (supplier power) and can be used to develop purchasing strategies. The cells in the matrix correspond to three basic risk categories, each of which is associated with a different strategic action.

Action planning:

Plan the steps you can take to use your purchasing power and reduce your suply risk. The matrix shows us three main strategies that we can apply:

Exploit – use your high purchasing power and procurement leverages to achive good prices and cost advantage. When our company plays a dominant market role and the strength of suppliers is assessed at medium or low level, an aggressive strategy is recommended. Because the risk of supply is low, the company has a better chance of achieving positive profit through favorable price agreements and contracts. Nevertheless, we should ensure that our agressive strategy will not crashed long-term relationships with suppliers.

Diversification – Reduce the supply risk by looking for alternative suppliers or alternative products. If our company has little impact on the mareket and suppliers are strong, the company must use safe strategies, start looking for substitutes for materials or new suppliers („diversification”). It may be necessary to increase expenses for market research or supplier relationships, and even consider backward integration through large investments in research and development or production capacity.

Balance – Choose an intermediate path between the exploit approach and the diversification approach described above. For products that do not have high risk or greater benefits, a defensive attitude would be too conservative and expensive. On the other hand, agressive apporach can harm relationships with suppliers and lead to retaliation. In this case, the company should implement a well-balanced indirect strategy.

In this phase, we should create several scenarios, clearly identify the appropriate risks, costs, profits and strategic consequences, and develop a preferred option with specific objectives, steps, responsibilities and emergency reactions.

When planning individual actions, you can use the OA capability matrix to determine which of them will be priority, and which can be included in the so-called category: quick wins.

AUTHOR COMMENT:

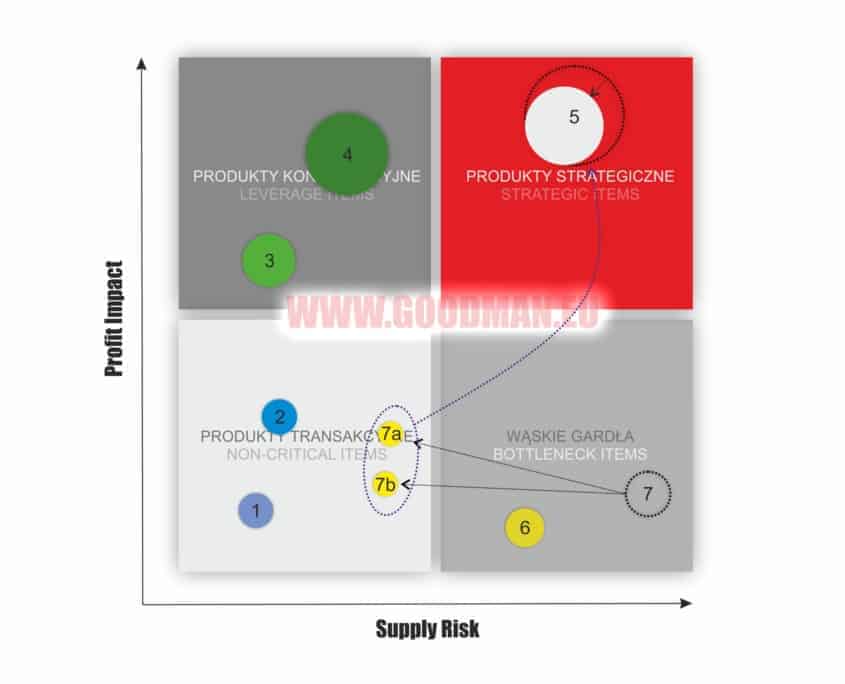

The presented model can also serve us as a simple and effective tool to control the implementation of the procurement strategy. We can track the position of supplier, and the vector of change indicates to us whether the initiatives taken by the buyer bring the intended effect what you can see on below picture.

Due to trends ont the market and our profession, we suggest to suport Krajlic matrix with two basic strategies: SRM (Supplier Relationship Management), and consolidation strategy as the second

Thank you for your attention.

The above model is discussed in detail in theory and practice on our trainings!

Best Regards

Grzegorz Olechniewicz

GOODMAN GROUP Sp. z o. o.

GOODMAN GROUP Sp. z o. o.

Dodaj komentarz

Want to join the discussion?Feel free to contribute!